Marshall Islands Launches Groundbreaking Cryptocurrency Universal Basic Income

The Marshall Islands has made headlines with the launch of a pioneering national universal basic income (UBI) initiative that incorporates cryptocurrency alongside traditional payment methods. This ambitious program aims to provide financial relief to residents amid rising living costs, marking a significant step in socio-economic development.

A New Financial Paradigm

Under the new UBI program, every resident citizen of the Marshall Islands is set to receive approximately $200 on a quarterly basis. This initiative aims to support individuals facing economic challenges, particularly as the nation contends with increasing living expenses. The first payments under this program were distributed in late November, giving recipients the flexibility to choose their preferred method of payment—whether through a direct bank transfer, a paper check, or a cryptocurrency payment delivered via a government-backed digital wallet.

Finance Minister David Paul emphasized the government’s commitment to inclusivity, stating, “We the government want to make sure no one is left behind.” He remarked that while the quarterly payment may not be substantial enough to deter people from traditional employment, it serves as a “morale booster” for many.

A Unique Financial Strategy

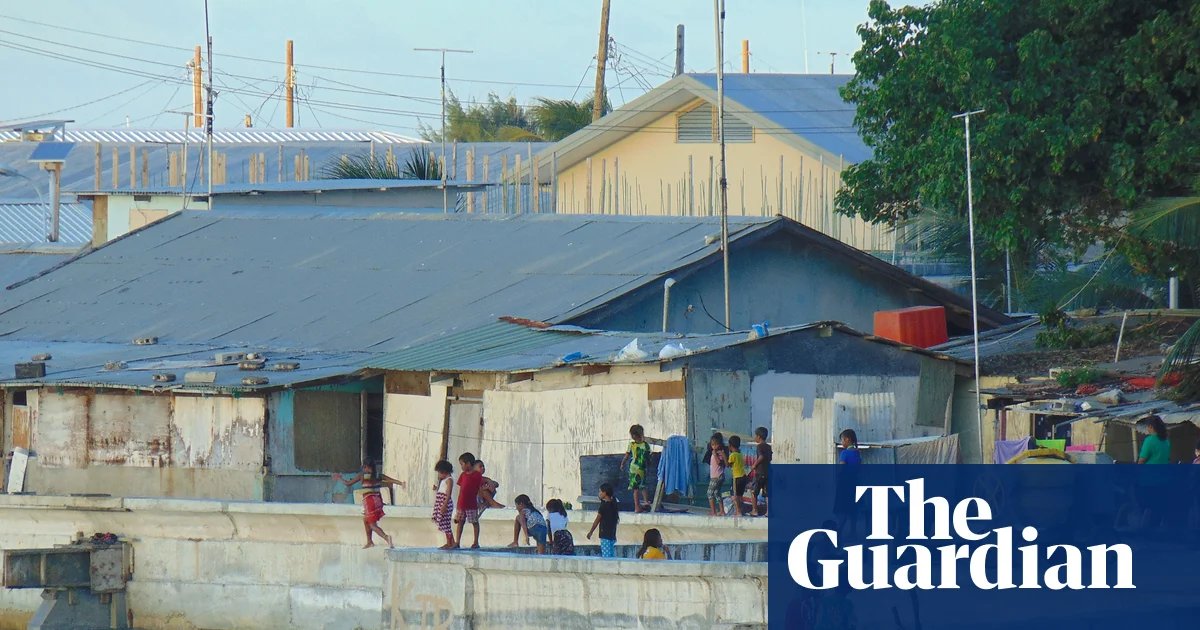

Located in the Pacific Ocean, the Marshall Islands comprises around 42,000 citizens. Paul described the UBI payments as a vital “social safety net” designed to combat the economic pressures faced by residents, including the challenges posed by an outflow of citizens seeking better opportunities elsewhere.

This innovative UBI initiative is financed through a robust trust fund established in conjunction with the United States, which compensates the Marshall Islands for decades of nuclear testing. Currently, this fund holds over $1.3 billion in assets, with an additional $500 million pledged by the U.S. through 2027.

Dr. Huy Pham, an associate professor specializing in cryptocurrency and fintech, noted that the Marshall Islands’ UBI rollout is “the world’s first for a national rollout of a UBI program.” He highlighted that integrating blockchain technology into the system is a unique approach to nationwide implementation.

Blockchain and Stablecoins

The cryptocurrency aspect of the program utilizes a stablecoin pegged to the US dollar, designed to streamline the distribution of funds across the archipelago’s numerous remote islands. Paul remarked on this technological opportunity, stating, “We saw the opportunity in what the blockchain has to offer.”

While blockchain technology is best known for powering cryptocurrencies, it can also facilitate the transfer of more conventional assets, such as government bonds, thus providing a solid basis for the digital payment scheme.

Barriers to Financial Inclusion

However, some experts caution that merely adopting digital payment solutions does not guarantee financial inclusion. Dr. Huy Pham pointed out the importance of enhancing internet connectivity and smartphone access, stressing these elements are crucial for a functional blockchain-based economy.

Interestingly, most participants in the UBI program have opted for traditional payment methods. Statistics indicate that approximately 60% of recipients preferred bank deposits, with the remaining payments issued as checks. As of now, only around a dozen individuals have chosen to receive their payments through the digital wallet, part of a small pilot program that successfully achieved its initial targets.

Finance manager Anelie Sarana indicated her team has been actively engaging with residents in the nation’s most remote areas to facilitate registrations for the UBI scheme. She noted that many recipients have used the funds for essential purchases, like food, while others have invested it in celebrating cultural events, such as the annual Gospel Day holiday coinciding with the initial distribution.

Looking to the Future

This venture isn’t the Marshall Islands’ first experience with cryptocurrency. In 2018, the government attempted to introduce a national digital currency, known as the Sovereign (SOV), though this initiative was ultimately interrupted due to warnings from international financial institutions.

Despite the potential risks associated with this innovative approach, such as concerns regarding financial integrity and governance, experts like Dr. Monique Taylor see value in the scheme for small island nations. She noted that in areas with limited banking infrastructure, a digital wallet could significantly reduce barriers and enhance the accessibility of financial services.

Conclusion

The Marshall Islands’ UBI initiative not only represents a leap toward financial innovation but also raises critical questions about sustainable economic models in geographically dispersed communities. As the world observes this unique experiment, it may pave the way for future strategies blending technology with social welfare in similar contexts.

- The Marshall Islands has launched a groundbreaking UBI program using cryptocurrency.

- Eligible residents receive $200 quarterly, with various payment options available.

- Funding comes from a trust with substantial U.S. backing, aimed at addressing economic challenges.

- Experts highlight the importance of internet connectivity for the success of digital financial initiatives.